FITBIT: WHAT'S NEXT?

BUS 478: Strategy

Satoru Higashiyama, Shirley Kum, Byron Lam, Natalie Lau, Brian Lim

The wearable technology market has seen particularly significant growth in recent years. With a growing trend of hyper connectivity and healthy living, our group chose Fitbit as the company to analyze since it is the forerunner of wearable devices and fitness activity trackers. We wanted to focus on ways that Fitbit can strategize to maintain a competitive edge over the competition and continue their growth since their decision to go public on June 18th. My role for this project involved market research, strategizing, and presentation design.

THE PROBLEM

Fitbit’s sales will be impacted by the new entrant of smartwatches

Fitbit Inc. is currently the market leader of the wearable technology industry owning 34.2%; however, they are facing strong competition including other fitness bands like Nike’s Fuelband and wearable technology like Apple’s iWatch/ Google’s Android Wear. As the fitness activity tracker market share is estimated to contract to 20% in 2019 (down from 34% in 2015), there is an anticipated shift in sales from activity bands to smart watches due to the latter products' features, as well as a change in market demands and consumer behaviour.

THE PROCESS

Leveraging Fitbit's competitive advantage against its competitors and choosing the optimal strategy

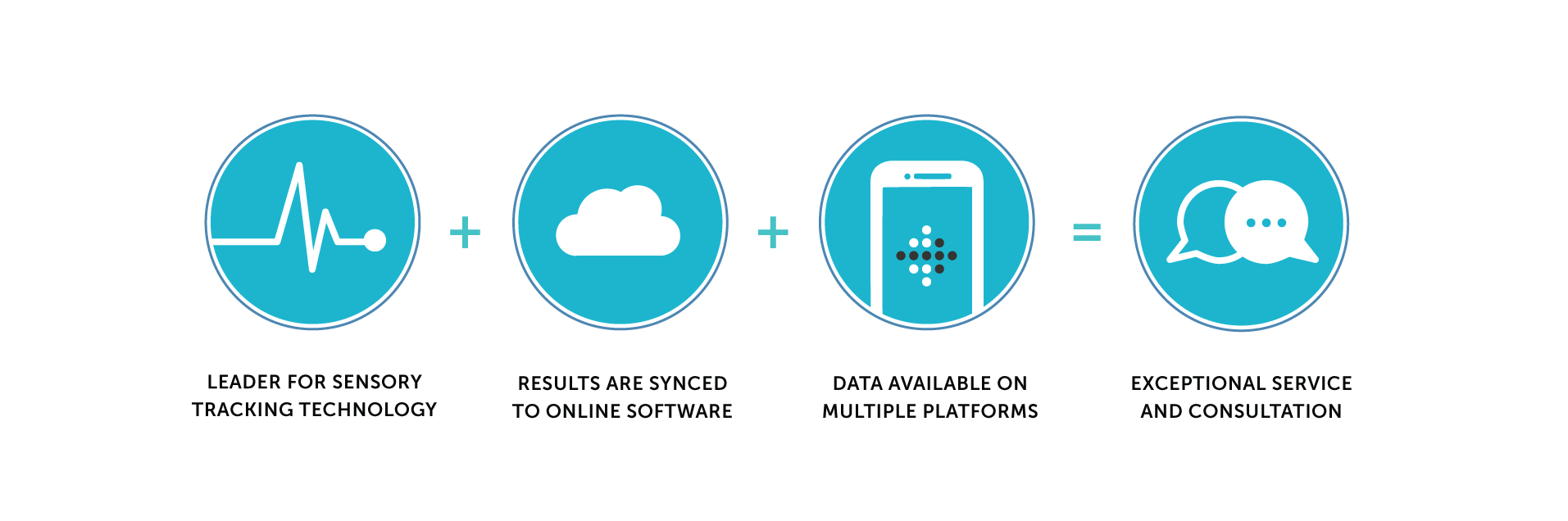

My team began this project by trying to figure out what made Fitbit so sucessful. After thorough market research, it became apparent that the Fitbit formula consisted of 3 components: superior sensory tracking technology which allows for accurate measurements, online software synchronization that enables in-depth activity and sleep reports, and compatibility with multiple platforms which means increased accessibility. Together, these competitive advantages enable Fitbit to provide a virtual consultation towards a healthier lifestlye to its users.

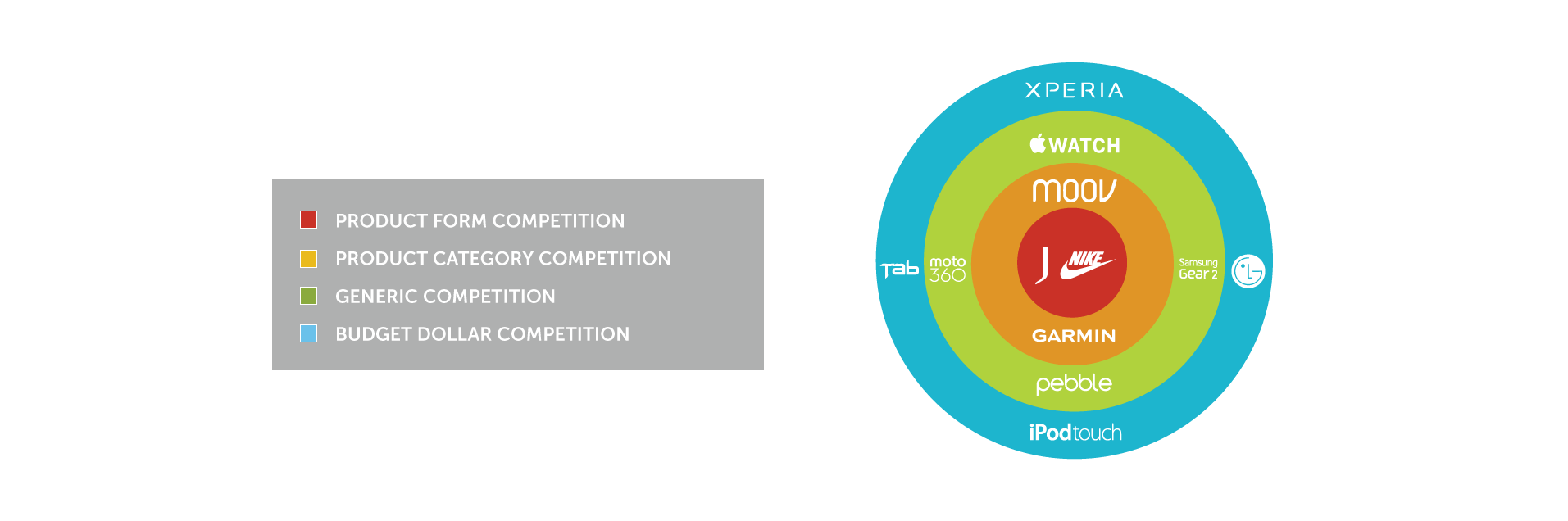

We then looked at the competitive scope of the fitness tracker market and concluded that smart watches pose an immediate threat to Fitbit's sales as both segments essentially compete for the same consumer budget dollar. Sepcifically, Samsung's position as the market leader in the smart watch segment (23% of the market share), as well as the recent release of the Apple watch, is bound to disrupt the wearable technology market.

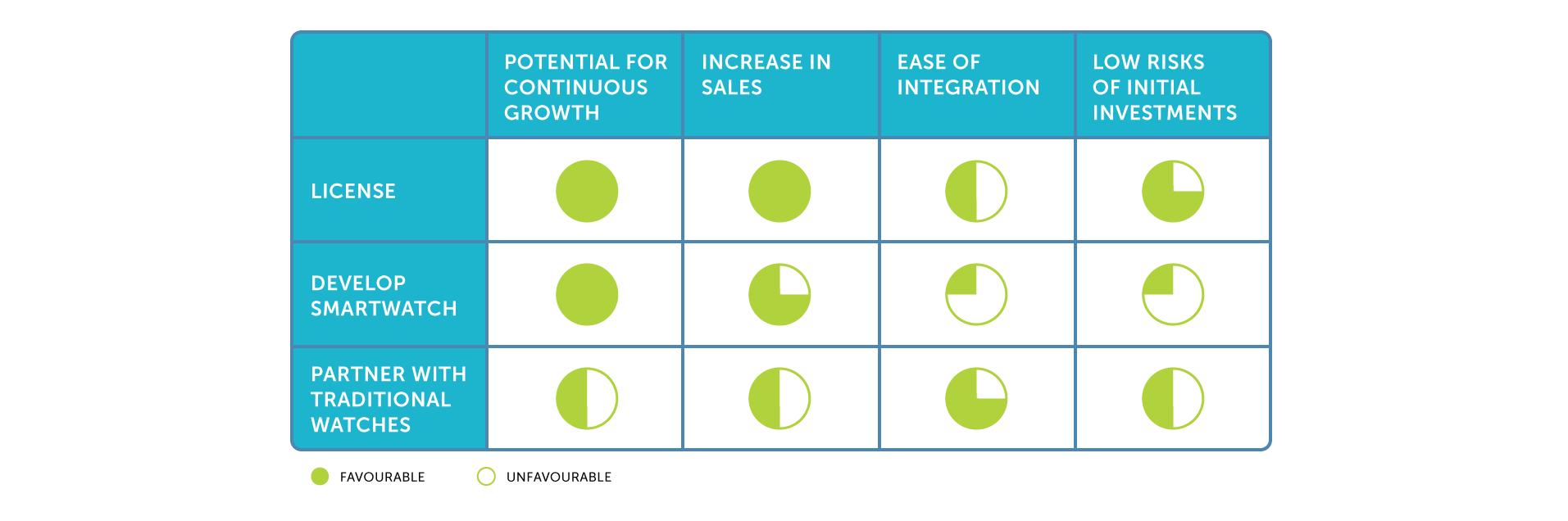

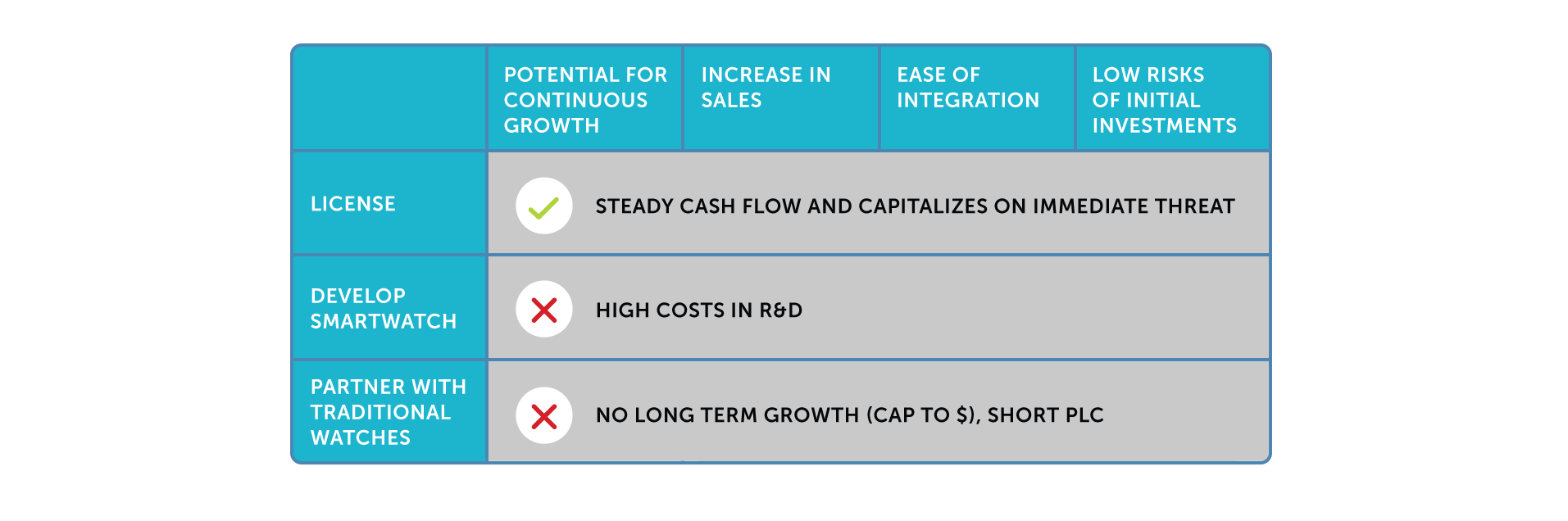

So based on our identified issue of smart watches entering the wearable technology market and causing an impact on Fitbit’s sales, we’ve come up with 3 alternatives and used a matrix to decide which was the best strategy to choose.

1. License the Tracking TechnologyThe first alternative is for Fitbit to license its technology to companies that manufacture smart watches. Specifically, this means leveraging its patents and licensing its hardware and detailed motion data tracking technology. This creates 2 segments of consumers: those who want to use Fitbit as a standalone product, and those value convenience and prefer to buy an all in one product with multiple functionalities, like a smart watch.

2. Develop Fitbit Smart WatchesThe second alternative is for Fitbit to develop its own smart watches. Currently, the smart watch market is valued at 33.7 billion dollars, which means that there is a lot of potential to earn a substantial revenue. For example, even if Fitbit captures just 1% of this market, it would be earning 4 times more than its current revenue. However, this alternative requires large investments and lots of in house R&D.

3. Partnership with Traditional WatchesOur third alternative is for Fitbit to partner with traditional watches, and to create a new product line that incorporates Fitbit’s technology into traditional watches’ housing. This option allows Fitbit to leverage on the traditional brands’ brand equity and distribution, while they leverage on Fitbit’s technology.

THE OUTOME

Licensing Fitbit's technology in order to gain a steady cash flow and capitalize on the immediate threat

In our matrix, we looked at 4 criteria: potential for continuous growth, increase in sales, ease of integration, and the risks of initial investments. After much consideration, we did not choose alterative 2 because of its high R&D costs; this alternative may also drive Fitbit away from its core competence of creating purposeful hardware and software technologies for fitness tracking. Similarly, alternative 3 is also not ideal before of the cap to long term growth. Ultimately, our decision was alternative 1, which is to license Fitbit’s tracking technology to companies that make smart watches. Not only does licensing provide a steady cash flow, it also capitalizes on the immediate threat of smart watches entering the wearable technology market.

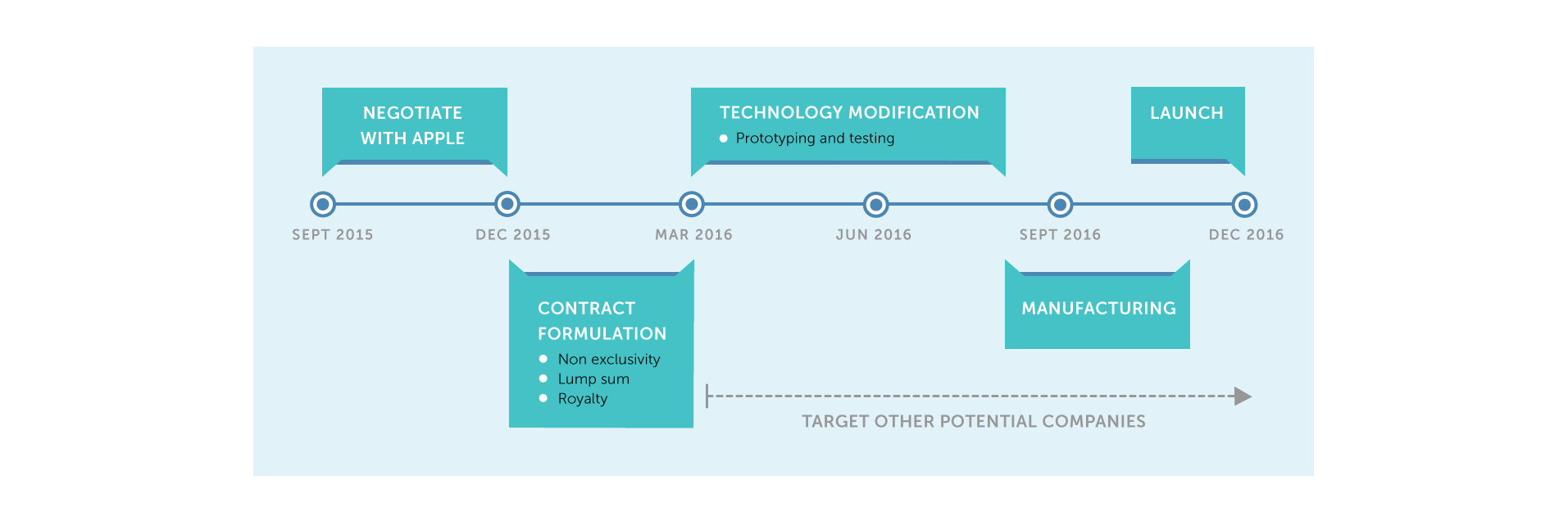

Specifically, our recommendation is for Fitbit to partner with Apple as it is a reputable company with 75% of the smart watch market (2015) and a $15 billion cash reserve. While Fitbit can benefit from this partnership, Apple can also leverage on Fitbit's technology and use this opportunity to improve its products' poor fitness tracking abilities and third party fitness apps. With this alternative, the projected subpar revenue in 2017 is $36 million, estimated revenue is $73 million, and optimal revenue is $109 million.

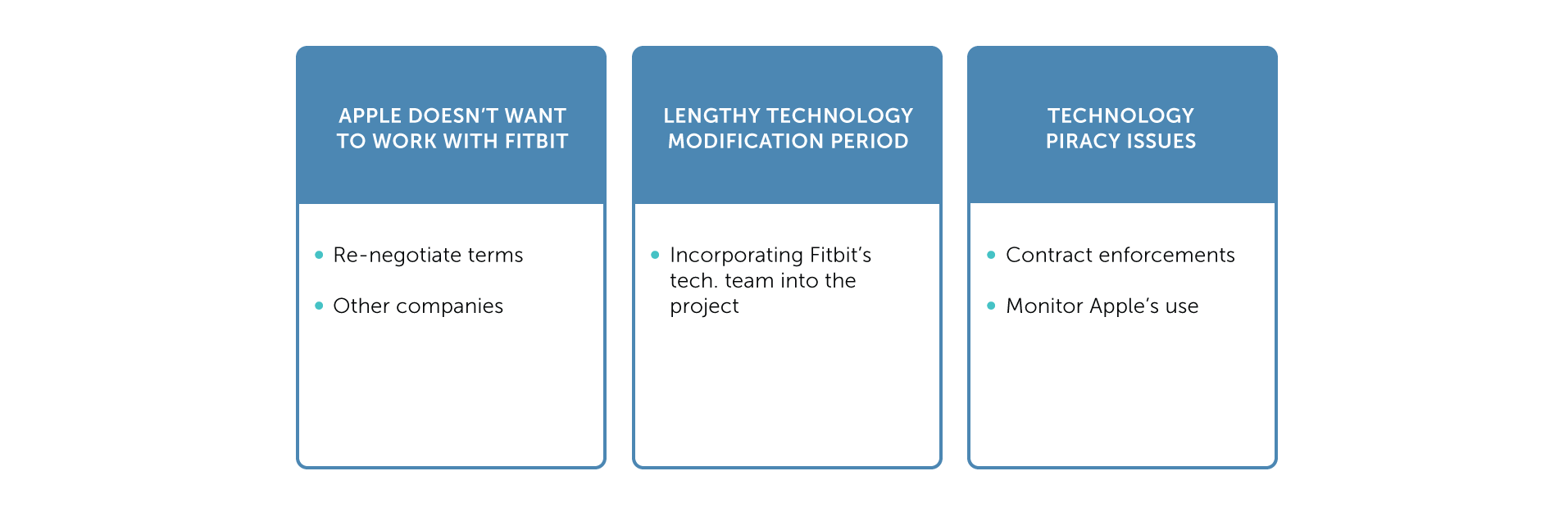

To complete our proposal, we also discuss the possibility and implementation of different risk and mitigation plans, as described below.